By Jim Crocker, past CEO and now Chair of Boardroom Metrics. Jim works with private and not-for-profit clients on corporate strategy and governance. His partner Karen McElroy leads an international business writing team that helps clients write and win RFP's.

Monday, December 29, 2008

Wednesday, December 24, 2008

Tuesday, December 23, 2008

Monday, December 22, 2008

The Plight of the Canadian Small Cap

It reads like the story of a traffic cop who shows up late to the scene of a head-on and looks for lessons in being a traffic cop, not the head-on.

Which is unfortunate because there are some important lessons about the plight of small caps everywhere.

The first is you don't want to be one. Being a small cap is like running a weather station in the arctic. A few people find your signals interesting but overall, being a small cap means being irrelevant. Which is why if you've made the mistake of becoming one, you'd better have or figure out a way (grow fast or sell) to not be one. Fast.

Secondly, learn to market and sell. In this case the company went public because they needed the cash. They needed the cash because they were way more comfortable inventing new stuff instead of selling what they had. When that happened....when they did start selling what they had...growth and profitability were easy.

Thirdly, it's way better being a company with a unique product that solves a customer need, than being a company with a unique core competency in search of a customer need. In this case - driving laser beams is cool, but the profitable, untapped market applications are all niches, not mass markets...meaning a never-ending search for more places to apply the core competency.

Ultimately, management made the fatal mistake of chasing a saturated, low margin mass-market that sealed its fate.

Finally, bad governance kills - whether you're Goldman Sachs or a company few people have heard of. The governors in this case made a series of questionable calls. A key one was not recognizing early on that selling the company was a legitimate option for creating shareholder value. Ultimately, that is exactly what happened, but years later and at gunpoint/low value. Ultimately, its not clear management or the Board ever recognized the reality of the company's capabilities, it's markets or of being public.

Bottom line. Small caps face the same challenges as all small companies but RUN differently because they're public. For companies who haven't mastered the basic challenges, dealing with the differences can be a killer.

Saturday, December 13, 2008

Off for a week

- welcome back, it's a good move

- stay focused on sales - don't get distracted

- leadership is all about confidence - you're going to do great

- change isn't easy but this will be ok - hang in there

- it would be really cool if you worked out!!!

Have a great week.

Thursday, December 11, 2008

Where the Clues Are

Because my role involves walking into companies I don't know and learning their businesses I get to hear a lot of what people in organizations THINK their business is about....who their target customers are, where they make their money, where there dollars are going, etc, etc. Pretty basic stuff.

And, in one company out of 5 or so, what the organization thinks and what reality is are actually in sync.

Too many companies though, run their businesses based on folklore.

They run their business based on some outdated, half-cooked, never verified perception that is repeated from the top-down without question.

My company is called Boardroom Metrics. I chose the name to reflect the need for managers and directors of companies to get the facts about their business first, then make decisions based on those facts.

When I go into organizations, gathering the facts is one of the key activities that gets organized. It's easy to show everyone "THIS is where the clues are".

Sometimes, getting the facts isn't easy. Market data, particularly in new or underdeveloped markets can be frustrating and misleading. Poor tracking of key customer characteristics, like age, gender or income level can make knowing who the customer is almost impossible.

If the facts don't exist, then beginning a collection process is key.

When the facts do exist they are always, always enlightening.

So, question. You're reading this post. You run a Board, an organization, a department. What facts about your business have you taken for granted, but never verified? What facts don't you know? What facts might change your business?

Go get 'em.

Owner Operators

At least one response was positive.

Yesterday's post was not a shot at owner operators. Why would I do that?

It was a warning.

Something to think about.

I do a lot of work with owner operators. Most of them running companies that are performing below expectations.

And do you know what I see? I see the same leadership issues EVERY COMPANY I go into.

The issues are SO similar, I start to question whether maybe the issue is me. Maybe I'm losing it - perhaps it's my perspective that has simply shut down. I've stopped looking for creative or unique solutions; no longer capable of looking beyond a few well-trodden personal beliefs. Maybe that's the case.

But here's what drives me to keep exploring it. The businesses where the owner-operator has gotten it - taken some advice, learned how to manage, learned how to trust, stepped back...and changed to adapt to new realities....have all succeeded.

And those that haven't are either just hanging around, or are out of business.

Coincidence?

Tuesday, December 9, 2008

Why owner operated businesses fail...

....because running a business is different from owning a business

....because you don't have any business experience outside the one you own

....because you'd rather be the CEO than the owner

....because you don't trust anybody but yourself

....because you think employees who suck up to you are employees you can build the business

around

....because you're open to ideas so long as they're exactly the way you want it done

....because you were successful once before and you think you are a genius

....because by the time you see the mess you've made it will be too late.

Saturday, December 6, 2008

CEO Xmas letter and speech on Google

Here's a screen capture from Sitemeter, the web analytics tool I use. It shows some of yesterdays referrals to the Boardroom Metrics CEO blog. More than half of them are looking for information on either a Christmas letter or Xmas speech.

Key point: this is search marketing.

Understand what customers and potential customers are looking for (in this case CEO's or their assistants).

Be there (blogging, website, youtube, other, tags, keywords, etc), when they're looking for it.

There is no more efficient way to market.

Here's the post with the letter or speech from yesterday.

Friday, December 5, 2008

How to Use Linkedin

Oh, and standard Powerpoint is dead. Way, WAY dead.

Below is Guy Kawasaki's presentation on using Linkedin. Everyone is on Linkedin. Using it well? Not so much.

Thursday, December 4, 2008

CEO Christmas Xmas Letter or Speech

So I got thinking. My friend's letter isn't much help. But some time ago, I gave this semi-decent (it got good feedback) speech at a client xmas party. Maybe there's something helpful here...either for a Christmas letter or hey, steal it for a speech. Here it is:

Hello everyone. I want to extend a warm welcome to employees…and their guests. Welcome to the 200X Jumbo the Clown Christmas/Holiday party.

Is anybody else here just a little shocked that we’re already at this time of year again? For me, it’s been exactly 12 months since I became involved in a management role with Jumbo the Clown. Although this is my first party, I still remember talking to Thing One and Thing Two like it was yesterday, planning for our 200X kick off meetings.

That was a year ago? I was shocked talking to Mr. Colours and Thing Two last week – we’re already planning our 200X+1 kick-offs – we need to be – its almost January!!

This has been a very interesting and successful year for the company. I would say challenging too but really, every year has its challenges. We’ve come through this one as you would expect – strong and full of momentum. In 200X-1 we had our biggest year ever. This year, 200X we will exceed 200X-1. This will be our biggest year ever.

On Monday, the management team will present our plans for 200X+1 to the Board. Our goal is to make 200X+1 even more interesting…and successful than 200X.

There are some people in audience that deserve a lot of credit for our success in 200X……all of you.....

....From the people in sales and marketing who help us bring in the business….

through the service, admin, IT and ops people who ensure we process the business…..

through the corporate accounting people who make sure we still have a business…..

through the governance people who keep the regulators out of our business….

and the support staff who help all of us – at least on the management and investor teams, go about our business…..

your dedication to this company, its customers and its employees is clearly recognized and appreciated. We do not take it for granted. Thank you. All of you.

I do specifically want to recognize the hard work of the employee council. Thank you for organizing this party and all of the other important employee events throughout the year. Your hard work, much of which takes place outside of regular business hours is the glue that helps make this company what it is. Thanks again for what you’ve done. Am I right in thinking you’re glad you know longer have to report to me?

In addition, I want to thank the investors for a couple of things. I joked (sort of) when I got this job that they were doing something quite brave in stepping away from their day-to-day roles and providing me and the new management team with this opportunity. We appreciate it and we will not let you down.

Secondly, you…the employees….need to know that the candy canes all employees received this year came as a result of the owner’s on-going generosity – I was merely the messenger. I think they deserve a hand of appreciation. I personally want to thank them for their support in running this business.

In closing, have fun tonight…..Have a great holiday season…. Be safe……And sincerely…..thank you.

Unfortunately, I was fired about a week after giving this speech (actually I gave it, knowing I was going to be fired). But what the heck....the party was good, the speech went over well and everybody had fun....oh, and Jumbo the Clown has never matched the kind of success the team achieved that year.

Wednesday, December 3, 2008

Ho Ho Ho

Tuesday, December 2, 2008

Judging People

Over the past two weeks he has shown himself to be exactly what I feared and Canada has been thrown into a leadership fright box. Harper should step down. He's a scary dude with a vision for this country that few people understood. Now that they're catching on, it's dangerously late.

Saturday, November 29, 2008

Sense of Urgency

"This is really bad," Cook told the group. "Someone should be in China driving this." Thirty minutes into that meeting Cook looked at Sabih Khan, a key operations executive, and abruptly asked, without a trace of emotion, "Why are you still here?"

Khan, who remains one of Cook's top lieutenants to this day, immediately stood up, drove to San Francisco International Airport, and, without a change of clothes, booked a flight to China with no return date, according to people familiar with the episode.

Thursday, November 27, 2008

Kill First, Investigate Later

At a management off-site the other day, when discussing leadership styles, he explained that in Mexico they have a saying, born from years of brutal leadership - "kill first and investigate later". It was pretty funny.

We've all seen companies where that's the leadership style. Something goes wrong. Shoot somebody.

It's highly ineffective. It just about guarantees that no one in the organization but the leader will make a decision or take action. Progress, trust, teamwork, initiative are pretty much all out the window in those organizations.

Lots has been written about how organizations and employees have changed...about the lack of loyalty shown by either side any more.

It's true.

I still find it bothersome based on years of observation, how acceptable and easy firing one, several, many employees has become. OK fine, the business is well managed, the bottom falls out for whatever reason and survival is at stake - then I get it. I've been there.

But too often what I observe is that's not the case. Hirings are done poorly and without proper planning. Lack of training ensures the employee never reaches their potential. Strategic planning and day to day leadership are haphazard. The organization staggers from trouble spot to trouble spot. And employees get shot.

When companies are hiring, if they know what they're doing and to avoid mistakes, they do their homework on the potential hire.

Employees jumping to new organizations should do the same.

Sure the job sounds great but do some research! Find out what the leadership style is. Find out how the company is managed. Figure out what people in the organization think about their organization.

Here's a simple tactic - don't take the job without interviewing at least 3 people in the company at or below the job level being considered.

Get on Linkedin. Hook up with past employees.

Sure it's a pain, but it could save some serious job grief down the road.

Sunday, November 23, 2008

As we melt down...

Dear Sir:

The debate about whether or not to bail out the Big 3 very quickly gets around to the issue of the merits of bailing out “lousy companies like GM” even as be bail out “great companies like Citi Bank and Bank of America.”

It is hard to defend a company whose market share has be halved in the last 20 years and is clearly on the way to bankruptcy without external help. But “a lousy company?” Let’s think for a second about what it takes to produce a successful car.

Five years before launch, the marketers need to anticipate consumer desires, competitive offerings, the regulatory environment and the price of gas. Then the product development engineers and designers get involved with everything from power plant choice to body shape to number of cup holders required. Once they come up with something everyone likes, the production, manufacturing and sourcing people get really busy. As launch date approaches, sales and marketing revs up again to build a little buzz and and hopefully get off to a fast start, despite automotive writers’ blatant attraction to expensive foreign vehicles. A successful car needs to look good, feel good, work well, have almost no quality issues either initially or for the the first few years and of course has to evoke the right emotions.

Banks by comparison need to do three things well to be successful. They need to convince people to deposit their money. For that there is and always has been FDIC (government) help. They need to convince people to borrow. For that there is interest deductibility and other incentives. The third and final requirement is properly assessing credit risk.

US car companies have gotten it right much more often than wrong lately, although the often subsidized foreign competition keeps raising the bar.

Banks on the other hand seem to have difficulties executing more than two out of three fundamental tasks.

Might it be that we are being overly critical of the wrong industry?

My friend notes that merely asking "are you good for this money - prove it" - would have gone a long ways to avoiding the melt down that's underway. That way school teachers wouldn't have been owning $2 million homes and driving Mercedes.

Good news here. Canadian banks always have and still do (according to another friend who just renewed his mortgage) ask that.

I wonder if that will make any difference now?

Friday, November 21, 2008

Thursday, November 20, 2008

The Inward Focused Business....

The outward focused business knows who its customers are. Understands what its customers are looking for. Exceeds its customer's expectations.

The outward focused business knows how to sell.

The outward focused business has confidence.

The outward focused business is proactive.

The outward focused business gets results.

The outward focused business is a better place to work.

Going from being an inward focused business to an outward focused business isn't difficult.

It's a mindset shift. Starting at the top.

Wednesday, November 19, 2008

GM....Just Wondering?

Then, yesterday something happened that's never happened before. The information center in the middle of my Enclave's dash was ablaze with warnings that my left rear...and right front, tire pressures needed checking.

You know if it had been one or the other, I might have fallen for it - but both at once, out of the blue....hmmmm. I checked. They were both fine.

And when I drove home in the evening, the warnings had stopped.

Then, last night I got a VOICE MAIL FROM GM telling me to take my car in for service.

You'd have to be in a coma to know GM is likely only days away from going down - which is probably as good a reason as any for getting my car serviced - but has it come to this? Is GM attempting to force its customers into dealers for service so they can pick up a bit of extra cash?

I never thought about it, but given that OnStar sends me monthly emails with my tire pressure and lots of other information, I presume manipulating my tire pressure warning system isn't too far fetched? Is that possible?

Will I take GM down if I don't get my car serviced?

If they do go down, will I ever be able to get my car serviced again?

Just wondering.

Saturday, November 15, 2008

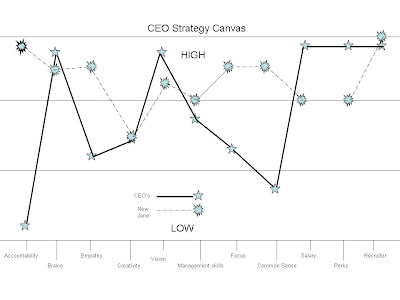

Applying the Blue Ocean Strategy

'Blue Ocean Strategy' is a book written by Chan Kim and Renee Mauborgne.

It's good. Like a lot of strategy books, it has useful tools for strategizing and visualizing strategies.

The key thrust of Blue Ocean Strategy is that there are two strategy streams - red ocean strategies for companies competing head-on in existing market spaces (strategy for losers) - and blue ocean strategies for recreating the market space and avoiding competition all together (where real winners come from).

Cirque du Soleil, Canada's circus theater company, is used as a center-piece example. Flush the expensive elephants and tigers, develop a theme, move to multiple venues in Vegas, jack the ticket prices and....voila - the non-circus, circus that's very, very successful.

When I come across intriguing new concepts like this, I like to try them on simple stuff (perhaps the only stuff) I know.

Like me.

This really isn't what the authors of the book had in mind when they wrote the book. They were thinking businesses, not people. But why not? I have a business.

Applying the Blue Ocean strategy to me the consultant and executive coach was a little confusing. Where I seemed to net out is that I probably need to up the process a bit, move to Africa and dye my hair blue. You'll see any changes in my updated profile.

Given the success of defining my own strategy better, I decided to move on to stuff I know way more about - other people's strategies. Like CEO's....keeping in mind that some of my best friends are CEO's.

The Blue Ocean Strategy goes like this.

First, define the key characteristics that make up the existing strategies for this 'industry'.

I defined the key characteristics of the CEO industry this way:

- brains

- determination

- empathy

- creativity

- vision

- management skills

- focus

- common sense

- salary

- perks

- friend who's a recruiter

Then, these elements are mapped on a strategy canvas. Like this.

Next, if you're an individual CEO (or business), you'd map your own 'strategy canvas'.

Let's take Jane, a hypothetical CEO.

Jane has:

- lots brains (see Jane on Jeopardy)

- lots of determination (see Jane work 20 hour days)

- big salary (see Jane drive a BMW)

- strong empathy (see Jane differentiate herself)

- modest creativity (see Jane surround herself with 24 year olds)

- OK management skills (ding, ding, ding)

- zero focus (see Jane multi-task)

- no common sense (see Jane blow-up)

- a very good recruiter friend (see Jane run e-Bay)

But, if Jane were to keep going, what else could she do to come up with a Blue Ocean Strategy for herself and escape the reaches of those other CEO types?

According to Kim and Mauborgne, Jane would figure out the following:

- what factor the CEO industry takes for granted that should be eliminated (like Cirque's tigers and elephants)

- what factors to reduce way below the industry standard (like the circus' fun, humor, thrills, danger)

- what factors to raise way above the industry standards (Cirque's unique venues)

- what factors to create, that the industry has never offered (Cirque's themes)

- the industry takes for granted that Jane will get a big salary; Jane could eliminate that and be compensated purely for performance

- Jane could reduce the following factors way below industry standards: her vision and other perks

- Jane could raise the following above industry standards: her focus, management skills and common sense

- Jane could create the following that the industry has never offered: accountability.

Jane could be FANTASTIC.

She could be a CONSULTANT.

With apologies to my CEO friends (and the authors) tools like this take time to use right. I'm not there yet. I've tried in real business situations also.

I'm working on it. When I get there, I'm going to develop a Blue Ocean Strategy, for strategy.

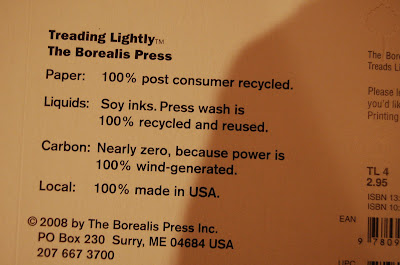

Treading Lightly

The card itself is kind of unique.

Here's some insight on the founder of Borealis.

Mark Baldwin, who started The Borealis Press, had a fair amount of experience in journalism, design, building houses, and operating a saw mill. One of his wooden bathtubs is owned by the Smithsonian Institution. He designed a "honeylog" that was credited with keeping captive bears from going crazy. But he knew nothing, zero, about greeting cards. Mark originated the photograph-and-quote card design, and runs the company, with a whole lot of help.

....journalism, design, building houses and operating a sawmill. That's my kind of resume.

Friday, November 14, 2008

Sunday, November 9, 2008

Business according to Mr. Google

His comment on the Longtail...that the internet makes the head even more important isn't new.... but it is worth keeping in mind.

Also, as a management consultant and observer of many different organization cultures, Schmidt's comments on management make me smile. First, that you need a leader to enforce deadlines in the group - "otherwise you have university". Second, that you need dissent - "otherwise you have a king". Simple, good insight.

Here's the link.

Friday, November 7, 2008

got a chance today...

.....to have a beer with a thoughtful, successful market watcher and stock picker. He has a theory on the market downturn that feels logical. According to him, the market bottom will occur only after the North American auto industry takes its hit - a hit which is clearly coming. Merger? Bailout? Bankruptcy? Get that done, get the headlines out of the way, absorb some of the fall-out - then we'll be at the bottom. Hmmmm....I think he's onto something.

...to make full use of local search on my Blackberry. Stuck in stopped-dead traffic. Pouring rain. Looking for a hotel....and finding one, plus phone number, plus dialing and connecting in about 90 seconds. Damn, the world has changed...and maybe even for the better.

Wednesday, November 5, 2008

Tuesday, November 4, 2008

"Business is simple....

How simple is business?

Provide a product or service that people want.

Do it well enough that it can be sold for a decent margin.

Market the hell out of it.

That's business.

Don't have a product or service that people want? Why buy?

Don't do it well enough to make a decent margin. Good bye .

Don't bother marketing the hell out of it. Drive by.

It's not that complicated.

So what's stopping so many businesses from achieving the success they desire?

People.

People who don't know strategy. People who can't execute strategy. People who can't focus. People who can't see the big picture. People who have all the answers. People who are afraid of the answers. People who can't follow. People who can't lead. People in the wrong roles. People in the wrong business. People who hate coming to work. People who hate going home. People.....

It's complicated.

Success in business is all about the people. The skills, the leadership, the mentorship, the accountability, the tough decision making, the communication, the motivation, the pulling together of huge diversity to achieve a common goal.

It's not so simple. But it can be simplified.

How do you know you have a product or service that people want? Do some research. Never lose sight of your competition.

How do you do it well enough to make a decent margin? Through leadership and hiring - never compromise on knowledge and skills.

And marketing the hell out of it? By being where your customers are in a way that your competition isn't.

There are two keys to success on the people side - talent and clarity.

From there, the rest is simple.

Please....get it right today...

Friday, October 31, 2008

Black People are Voting!

http://www.dailykos.com/storyonly/2008/10/31/54758/404/148/647683

"SFIL"

http://www.dailykos.com/storyonly/2008/10/31/94424/603/61/647786

Value vs. F'ing around

I like this person. One one hand I appreciate her enthusiasm. It's good.

On the other hand, I believe she is naively misguided....and (surprise) I told her so.

Two questions. First, how are sales? She knew the answer. Marginally down.

Second: How is profitability? I knew the answer. It's not what this organization has ever worried about.

I pointed out to her, that (in my humble opinion) spending lots of money, in fact more money than ever before to tread water or even sink below it is not progress. It's failure. Raw, ego centered botching of business basics. Profitability, of which I'm sure there's still some, is in the toilet.

It's the kind of predictable failure that enables not-so-sharp people like me to go ahead and predict the future. What she doesn't see....but soon will....is inevitable.

There will be lay-offs. By Christmas, January at the latest. Crazy perks, like bringing your neighbours pet to the Children's groundhog day party will be gone. Other expenses, like travel and meetings which this company overdoes on a grand scale will be cut back to nothing. Then there will be the inevitable search for ever-greater efficiencies. Why does a company with only a limited number of products need a head office of 100 people? There will be more lay-offs.

Then one day, the investors in this company will really wake up. Where is the value in this organization? In it's product? In it's back office and administrative capabilities? It's distribution network? Probably not. In fact, it's probably no where.

So now what? There's nothing like being stuck in an investment. Sure the lifestyle is good...and f'ing around, playing manager is fun. But no business is an island. When the recognition sets in that there is no value in the business and none has been created despite millions and millions in investments, then the fighting between the investors and finger-pointing on the management team will be spectacular.

Trying to be helpful, I suggested to my friend that given her capability, enthusiasm and desire to grow, she should start trying to influence a more thoughtful, business-like direction for the organization before the inevitable happens.

You know, she's good. I think she gets it. I don't think she'll be one of the ones laid off.

Monday, October 27, 2008

Dude, step away from the office

Today my broker called. He's been terrific through the market melt-down - keeping me informed, getting advice, sharing insight. I feel well looked after and frankly, lucky he's my broker.

What's happening in the market hasn't been easy for him. What we're going through now is unique, once-in-a-lifetime type stuff. He's seen a lot. He hasn't seen this.

The other day he was telling me how he was so pre-occupied, he only shaved half his face (unfortunately, as goofy as that sounds I actually had a better story - I showered and only dried my hair! - we had a good laugh). I feel for him.

Today he called to share his thoughts on the lessons learned from what we've just been through and how to protect for it in the future. He had an excellent plan.

You know, I appreciate it.

If more businesses would learn from the difficult experiences they go through, they'd stop going through so many difficult experiences. However, today I had a different thought for him.

"You're on the wrong track."

I know what's happening because I'm seeing it everywhere. Faced with adversity, uncertainty, fear...and frankly in some businesses, too much downtime.....people like my broker are working themselves into a frenzy. They're working overtime to come up with solutions to save the world, fix the past and cure cancer. All in one fell swoop.

You know what...he doesn't need to. It's the wrong thing to do. Knee-jerking and over-reacting into crazy but well-meaning directions is exactly how to compound the mess that's already out there.

This just doesn't apply to my broker. I know a business owner making the corporate version of the same mistake. He's like a crazed pyro-maniac lighting new fires everywhere he goes. Unfortunately, there won't be much left standing if he keeps it up.

So, here's the direction I gave my broker: your job is to maximize the return on my investment. There is RAW POTENTIAL to do that everywhere I look right now. At least in my lifetime THERE WILL NEVER BE A BETTER TIME to invest in great companies at huge discounts. Don't worry about inventing a better way to protect me so the next time this happens I don't get killed. I'll be dead anyways. GO AND MAKE ME RICH. Stop over-thinking this.

And for the business owner: man, you MUST get a plan - and stick to it. No, the economy isn't great and sales will slow down. But your product needs some attention. Now you're going to have some time to work on it. You're not going to execute any of that other stuff anyways. Blow this opportunity, AND YOU WILL BE OUT OF BUSINESS.

So, bottom line.... yes, there's stress and in many cases fear. But working long hours and coming up with new, crazy directions (working dumb) isn't the answer. The answer is probably something pretty basic. Something fundamental. And once you've figured it out....get out of the office...before you break something!

Funny Money

"Given our productivity, other than selling our resources, we have little to offer. Thus, our dollar is falling to where it should. Even our vaunted surplus is disappearing faster than we can blink as the drop in commodity price hits all aspects of government revenue (consumption taxes, corporate taxes, royalties, etc.), and has negative spin off effects into the general community which will only further drop government revenue. Lastly, our exports will fall and, since we produce nothing ourselves, imports will fall slower." b W from Canada

"I like the widespread denial in Canada and the Pavlovian response on blaming US. Housing bubble in Canada is as bad as in US, just read the other day that prices in New Foundland appreciated 30% in the last year, leave alone SK...Banks are not in better shapes, some of them CIBC and TD made their bets in US, too. Wait until, house prices drop significantly in Canada and all those mortagages become sour. The really abberation was having the CAD$ appreciating from 0.63 to 1.10 from 2002 to 2007. The CAD$ is reverting back to the mean, sometimes overshoots on its way down or up." FLORIN ARSENE

"Currency may regain its vitality quickly after funds stop buying U.S. dollars, yen to cover short positions, CIBC's Shenfeld says"

So, the reason why the US dollar is going is because of demand.

Not exactly reassuring, seeing as it implies a lot of trader are getting caught short (HA!) out there, but at least it's an explanation.

ie: not capital flight to security, but capital repatriation to cover the bills. Tiu Leek from Here

Sunday, October 26, 2008

Lehman Lay-off Dude

Saturday, October 25, 2008

Accountability...and the Comfort Zone

I don't believe I necessarily give good personal advice. But I care, I try to help and I try to be practical.

In this case, my initial advice kind of surprised me, although apparently I've given it before. What was it?

Get out. Get away from your family, your friends, me. Jump on the subway. Take a trip. Go to a bar. Do anything that isn't what you typically do.

Why? Because it will do two things for you. First, it will change your picture. Believe me, the world looks different on the subway. Or from 30,000 feet.

It looks really different in Arizona's!

Second, doing it will give you confidence.

No, jumping the subway isn't big. But if not's what you do - and you do it - and you survive - and you come home with a different picture - I guarantee you will have more confidence. And confidence, including the confidence to break whatever is holding you back IS huge. Try it two or three times and you will be hooked...and moving forward.

My other advice to her was way more practical. Start making a networking list. Make a list of people who know you're a serious talent and can help you.

Have you ever done this? For yourself or for others?

I think we all come to this exercise (at least those of us over 40 who don't have 900 friends on MySpace/Facebook) with the early thought "I don't know that many people". It's always the wrong reaction. Half an hour later, we had 35-40 names for her to call.

Making sure she calls should be easy. Early next week I'm calling her. She knows I'm calling. Her job is to have made the calls she's agreed to make. I'm her accountability consultant, her moving-on conscience. She will make this work.

By the way, my friend is a serious talent. Now in software; a Masters in biotech; ran her own very successful executive search firm in Toronto and New York; a trained OD specialist that has worked with Fortune 500 firms. She'd love to get back into the OD area. If you know anyone....??

Thursday, October 23, 2008

Why Talent is Over-rated...

Bottom line - according to the caption at the top of Page 1: THE CONVENTIONAL WISDOM ABOUT THE "THE NATURAL" IS A MYTH. THE REAL PATH TO GREAT PERFORMANCE IS A MATTER OF CHOICE. THE QUESTION IS HOW BAD DO YOU WANT IT?

Great. All I have to do is want it more and try harder. That's depressing. I was really convinced I could simply wing it better....!!

Over the past few weeks I've been meeting and talking to everyone who will listen about what makes a great, and not-so-great CEO. I'm not so sure simply trying harder is the answer. Here's what I've heard some keys to success are:

- experience - especially big company experience - go and get trained in places where they've at least thought about what they're doing - how to plan, how to execute, how to throw a great x-mas party

- brains - do you think Google, Microsoft and RIM are being run by dummies? they're not; sharpen up!

- insecurity - nothing drives drive like proving to your father you're better than he is - all those kids with perfect family lives and too much money - they're not going anywhere - why would they? they don't have anything to prove

- ego - insecurity's macho partner - knowing you're the chosen one even when nobody else can remember your name is a huge advantage - these people may be obnoxious to be around but they're not going anywhere...and then they're running the place

- luck - talk to any insecure egomaniac who's made it big; even they will tell you they got lucky somewhere along the way - of course their spouses will be the first to reassure them what we already all know - "but honey, you make your own luck"

- common sense - which as we all know, is very uncommon....therefore providing a unique competitive advantage that most of us walking around bumping into walls don't have

Wednesday, October 22, 2008

So much to do, so little chance of it all working

This year, there isn't as much confidence in simply winging it as there was last year. Little if any of the grandiose growth that was supposed to happen in '08 has occurred. Combine that with an unstable economic outlook for '09 and there's recognition that getting it wrong next year could have serious, if not fatal consequences (although in true Canadian fashion, all the CFO's I know are silently/not-so-silently high-fiving themselves on the decline of the Canadian dollar. That, more than anything is going to save a few jobs this year).

There's one fundamental issue every organization I know seems to struggle with. Defining, the small number of priorities that will actually make a difference in the year ahead.

Nothing stymies success like taking on the world of things that could possibly be done. First, tackling everything just about guarantees that nothing gets done. Second, when everybody is doing everything, accountability is impossible. Third, by tackling everything the high leverage activities remain invisible, under-resourced and untapped.

Figuring out the 3 things that WILL make a difference next year, not the 57 that COULD, isn't difficult. I try to keep the following things in mind.

- Perfection isn't necessary. If I'm close to picking the right 3 priorities, I will have have a much greater impact on the business by executing them well than burying the perfect priority under 56 others.

- Leverage, leverage, leverage. I call them super-priorities. Do them well and they will suck up 2/3rds of all the other cool stuff that could have been done. There's always priorities that have leverage way beyond what they look like on the surface.

- Why? What is the overall goal I'm trying to achieve? Growth? Profitability? Market place recognition? Everything else needs to tie directly, and neatly back to that goal. If it doesn't and if the question 'why?' can't be answered simply in about 6 words, then the priority isn't a priority, it's a make work project. Guaranteed it won't get done.

Saturday, October 18, 2008

W.

I wouldn't call it a great movie, just disturbingly real - including one of those weak, what the f? endings that leaves you wondering: a) does this mean W a lousy center fielder and it's a good thing he didn't play baseball? b) he just lost the ball in the lights and that's a metaphor for something way bigger, or c) why do I keep getting confused at endings like this?

The major themes of the movie, seem suprisingly close (in my mind) to what you might imagine they'd be, based on what we know:

- W - major daddy complex, in WAY over his head, driven to be the 'decider'

- Dick Cheney - scary, dangerous, wrong and unrepentant

- Iraq - it's the oil baby

- Iran - it's oil and world domination baby

- Carl Rove - everywhere, all the time, not his job

- Colin Powell - smart, right, weak and in the wrong place at the wrong time

- Donald Rumsfeld - mildly nuts and barely relevant

- George Tenet - he knew, but that wasn't what this was about

- George Bush senior - class act, cut from a different cloth, could fix everything for W. except the world

- Barbara - Bush

Bottom line, skip the movie. You saw it all on TV.

Thursday, October 16, 2008

Here's a post already!

Some thoughts. First, some time ago I decided to try out Twitter. There was a pretty good article in Fortune on it and back in the early summer, at the Search Engine Strategies conference here in Toronto, one of the sessions was dedicated to Twitter as a marketing tool.

My experiment with it has been limited. Like 6 posts. I follow 2 other twitterers and 2 follow me. Pretty pathetic. Despite that, I've had complaints!

Recently I quoted a post on Daily Kos about Sarah Palin. The post essentially suggests (you can read it) that focusing on anything other than her boobs would be a waste of time. Given all the noise about her at the time, it seemed like one of the most accurate observations on her I had seen. Ok it was a little crude. But, you have to admit, it's not like she has any other outstanding attributes.

However, apparently I offended at least one reader. Sorry. Maybe I should have said "focus on the fact that she's a boob"! (it's ok, I understand being offended :))

A while ago, someone said to me "who invented Republicans, anyways?". I don't have the answer. I just know that the past 8 years have been a disaster (who could foresee that electing people who don't believe in government AS the government would turn out bad?!) and how anyone in their right mind could put an idiot like her one step away from the Presidency is...dumb...unpatriotic....and good for funky glasses sales.

Ok, I'm on a roll. I have a comment on dog owner/walkers. You know those people with two (never one) of those crappy ass little yappy dogs...on those long leashes so they can go up and crap on your lawn? Did it ever dawn on any of you people that first of all, some of us aren't so enamoured with your crappy ass little dogs. We still wonder why you take better care of them than you do of your kids. Secondly, now that it's fall and gets dark early, walking your crappy ass little dogs all dressed in black is great f...ng way to get killed. Don't worry, your dogs will get out of the way...I know, I've tried. But you, walking with your back to me with your dogs strung all over the neighbourhood and me not seeing you til the last moment...you're done. At least get a white hat. And if I run you over, I'm letting your dogs off the leash so they can go play in traffic.

Now, on a more serious side. I've been telling everyone I know about the book 'Rise of the Creative Class" by Richard Florida. Very, very stimulating book. I'm hardly early to it, it was written a few years ago. Florida's studies show a compelling connection between the economic health of a city and the appeal of that city to creative people. His links between the gayness and ethnic diversity of a city and it's economic success are fascinating. Think San Francisco, Stanford and Silicon Valley. Now think Waterloo, Ontario.

University of Waterloo is one of the world's best math and sciences universities. It's one of the first places Microsoft goes for fresh talent. Walk it's halls and you will be overwhelmed, certainly by it's ethnic diversity, perhaps not so much it's gayness (although, I'm sure it's there).

Now go outside the University. Notice all the white people. Talk to those in the know about the success of the tech community in Waterloo outside of RIM. What the honest ones will tell you is 'don't believe the hype'. Waterloo is no Silicon Valley.

A friend of mine recently attended a well organized and very serious 'prosperity' event in Waterloo where the 'titans of Waterloo industry' (seriously, she said they called themselves that), pondered the options for attracting and retaining the best and the brightest to/in Waterloo. Two simple questions for my friend: first, of the large group that attended, how many weren't white? her answer: one; second, how many were gay?...her answer...gay?!

Maybe, I'm wrong and Florida should just stick to being the Sunshine State. But in my mind, until Waterloo crosses the diversity and openess chasm (and until RIM blows up and spins off a few hundred loaded and brilliant entrepreneurs), it will never achieve the magnet status it so craves.

But hey, I live in Toronto, what do I know?

Wednesday, August 27, 2008

Muskoka Sunrise

Been spending long weekends in Muskoka. Get to see sky up there. In the the city, not so much. This is early.

Tuesday, August 26, 2008

IT/System Engineer Search

- IIS 5.1 ( Win XP),6.0 (Server 03), 7.0 (Vista & Server 08)

- SOAP

- AvWebservices .NET

- Fortigate firewall

- Sharepoint 07

- Exchange 07

- VPN

- Dell hardware support

- ASP.net (a little code experience)

- Linux administration (phone and .NET code source)

- FreePBX (asterisks phone system) VOIP

- Wikis (R&D, Knowledgebase)

- Terminal server, Citrix, VMware (alternative environments)

- Backup software (Vertias, Symantec))

- Antivirus (Trend Micro, McAfee, Symantec)

- SQL 2005, 2008 would be nice

Sunday, August 24, 2008

Summer '08

Quick update on stuff.

Been spending Monday - Wednesday in Toronto then heading north to Muskoka for the weekend. Muskoka is Toronto cottage country. It's beautiful. Too bad the season is 8 weeks.

This is a lifestyle I could get used to. About the time something really starts pissing you off, you're sitting on a dock having a beer. Now if I could just get the helicopter to get me here...

It's also been great spending time with the kids. Both are home from school for the summer. One's working up here for the summer. She's getting her first true business insights working for a golf course that's part of a major, respected hotel chain....that seems to have very little idea what they're doing. The hotel they were supposed to open many months ago won't be open for another few months. Good things it's a fractional ownership. Because after Labor Day weekend, Muskoka is pretty dead.

The other just got back from Australia. I had to laugh (...or cry) at a comment he made on the weekend: "I don't think I like working". There's only one response I could think of..."how would you know?!"

Life has definitely changed for kids. Travel is big. Life-style is huge. I see the girls getting reality way more than the guys...and working way harder. It's cool to see their determination and hard work pay off in terms of opportunity and perspective. And they're doing way better as result.

However, I still see that guys are more street/how-low-is-the-bar smart...and that gives them a strong competitive advantage that frequently enables them to sneak in there, regardless of how hard the girls work. Women need to learn this skill.

Business-wise, I'm working with software companies, a software M&A firm...and a hospital. Every one of them a challenge and I learn something from every one of them too.

Over the years, I've become an indadvertent (unplanned) expert in partnerships. It's just something I've worked with almost everywhere I go. I know in a previous post I committed to capturing some of my learning - I still plan to do that. Partnerships are very interesting beasts. Anyone working in a successful, stress-free partnership should consider themselves lucky. I don't care how good you are, partnerships are not easy relationships.

Here's a bizarre one. I'm also inadvertently becoming an expert in coaching determined, strong, female entrepreneurs and managers. Again, it's just something that's developed over time on many different projects. Bottom line. These women are better managers than most men I know. They're great leaders. Solid with details. Masters of execution. No fear.

What they frequently lack is the inside track, networking and relationships that men lever the hell out of to get what they need. And not because these women couldn't do that better than most men too if they wanted to. Unfortunately - and I have no idea how you change this - men are intimidated by successful women. So it's easier to hang with the boys, ignore reality and keep the status quo.

My advice to these women: Get more like guys. Build your networks. Get to know the influencers. Learn to golf. And have options. Never be stymied. Have a plan and keep moving it forward.

Other stuff. Hmmm. Let me see....

I joined Facebook. Jim D Crocker. Have a few friends and still trying to figure what it does for me. More hits on Flickr?

Joined Plaxo. Jim Crocker. Even fewer friends. I haven't tried. But what I notice is that Plaxo seems way more business friendly than Facebook. I see way more business connections on Plaxo than I do on Facebook. My goal in September is to spend more time trying to figure out where both fit from a business, marketing perspective. Interestingly, all of my kids friends have said they'll add me as a friend. That could be interesting...and I guess it shows how they're growing up and Facebook is changing.

I remain a major search marketing evangelist. Being there when someone is looking for what you have is just way more efficient than shot-gunning your marketing budget all over the place hoping you'll be remembered when the time is right.

If you don't believe me check out the power of GPS combined with local search on the new Blackberries (and I presume i-Phones). Find your location. Local search for pizza...or whatever. And...if you're the closest pizza or whatever guy - you just got a new customer. It doesn't get any more efficient.

Anyways, summer's almost over. Hope it's going well for you too. I'll get back to this in September. Really!

Wednesday, June 25, 2008

Web 2.0 meets Crimson and Clover

Click the speaker button to hear the sound.

Thursday, June 19, 2008

SES Toronto Day 2

From the session on B2B, learned the following:

- 80% of buyers say they found their vendors - not the other way round - 45% say they found their vendors on-line

- Google - no surprise - is their dominant starting point

- vertical search engines like business.com are huge - with 70% of B2B buyers surveyed saying they go there for insight and info

- word of mouth - via the internet - and reputation management must be key marketing considerations for B2B vendors

- when buyers go looking on-line, the three biggest things they're looking for are products, pricing and features

- content on B2b websites must reflect the roles in the purchasers organization during the buying cycle

From the session on Web 2.0 and search engines, learned about new ways to add 'context' to web content - making it easier for the search engines to distinguish between Paris Hilton and the Paris Hilton.

Also heard the term SEO 2.0 for the first time. This makes sense to me. Search is evolving significantly as the web and 2.0 type applications like Flickr become main-stream. Learning how to integrate these into search marketing strategies will be fundamental - just as text, tagging and keywords are now.

Wednesday, June 18, 2008

SES Toronto Day 1

SES isn't necessarily of greatest benefit to publishers, like Longtail. But it's of great interest to traditional brand marketers and company owners who want/need their brands in front of potential customers.

Get this - 80% of all first interactions with a brand occur on-line now. If you don't show up on-line, you don't show up.

Search engine marketing - getting ranked high enough for customers to find you on the key search engines - is a relatively new art/science that is evolving at the speed of the web. Two years ago, SES was all about getting ranked first page on Google. Everything was text based.

That's changing. Fast. Thanks to 'expert' sites like Flickr (photos), YouTube (videos) and hundreds/thousands of others (press releases, customer reviews, social sites like Facebook), getting your brand noticed and ranking highly on Google and other searches can start anywhere.

Some key, simple learning for me as I advise my clients on basic marketing - make a video, take some screen shots, do some press releases - and load them on the web. Tag them with the appropriate keywords and cover your bases to get noticed.

As a result, the key theme from Day 1 of SES was not 'search engine optimization' but 'digital asset management' - going beyond web-site based approaches and branching out to the other 'filters' on the net that get your brand ranked and noticed. Put another way - getting your content - text, pictures, videos, reviews - out beyond your website.

Other practical learning - how to appropriately 'tag' your content to match what potential customers are looking for - not 'shampoo', but 'shiny hair'; not 'lending', but 'borrowing'; not 'document destruction', but 'shredding'. Speaking simple, customer-centric language, not marketese.

For expert advice on doing this and marketing your company on the web I can highly recommend my partner in Longtail, John Robb. His site and contact info is here.

Overall a good day at SES Toronto. Looking forward to today.

Tuesday, May 27, 2008

That Work Thing

Since last blog I've been doing more traveling, some interesting client stuff and more photography.

On the travel side I've spent the last 4 weeks visiting US cities in the midwest and east coast. Not so pretty cities like Philadelphia and Baltimore.

One of the things I've looking for is visible signs of that recession I keep thinking is out there.

Those signs aren't obvious. All the flights are full. In every case except one, my first choice of hotels was fully booked. In Philadelphia and Baltimore, my first choice of rental car companies was sold out.

Some of the business owners I met with told me they think they might be seeing a premature summer slowdown, but nobody seems sure. So there I go - wrong again?

Also since my last post, my friend Martyn Bassett of Martyn Bassett and Associates sent along a few questions and published some of my not-so-brilliant thoughts in his monthly newsletter. One of Martyn's questions caught my attention because I've heard it a few times from managers in companies of different sizes.

Martyn Bassett Associates: Some might challenge this view and say it (good governance) clashes with and interferes with the entrepreneurial spirit. What are your thoughts?

Jim Crocker: I think that way more businesses have been killed by unskilled entrepreneurs than by good governance. Having your own business doesn’t make you an entrepreneur. Take all the help you can get.

One final thought, I'm continuing to do a lot of work with businesses that are partner-owned. The issues that these businesses face are fascinating, sometimes scary, often destructive. Getting and keeping two partners, never mind more on the same page, with the same vision and the same business approach is a monumental challenge. Having now consulted for a large number of these organizations, I plan to start exploring some of the issues and ideas/solutions I've seen for dealing with them in upcoming posts.Monday, March 24, 2008

Innovation and Creativity - Follow-up

Those looking for more insight may want to check out the blog Creativity and Innovation. Their posts, innovation index and attendant insights are quite useful.

Healthcare and the Race for Free

(Note: I have to throw this in. While I'm not nearly as clever as Wired, I actually wrote a post on the race for free called 'Monetizing Data - The Race for Free back in December 2006'. $0.00 pricing IS an intriguing twist/opportunity on some business models.)

Reading the Wired article got me thinking. It's easy to see how advertising has supplanted pricing for some on-line services. But does the race for free, extend beyond the internet? Could it be extended?

I do a lot of work for a Canadian hospital. Hospitals in Canada mostly don't charge for their core services - there isn't a price list. Revenue/funding comes primarily from the government.

Over the past three years, management at this hospital has done their job reducing the fat from the organization. However, demand for their services continues to grow well in excess of their funding. In fact, funding doesn't even match inflation.

I got to wondering if Wired's theory might be applied to the hospital, eg, give hospital services away free to patients (what hospitals already do) and make up the revenue shortfall selling other products/services to other 'customers'.

Hospitals already charge their primary customers for some ancillary services (parking is a big one) but this isn't what I mean. In the free-services/other revenue model the hospital would be selling access to what it has - its customer base; large, skilled workforce, facilities and political clout - to anyone with a need for access to those things.

What about advertising? Advertising is a primary revenue source on the web - give stuff away for free, make revenue from advertisers. Who would advertise in a hospital? Seems to me anyone might want to although some products and services might be inappropriate.

This actually seems like an untapped opportunity for the hospital. It might not be huge - but the number of hospital visitors every year is large - I wonder what the revenue potential might be if every corner of the emergency department was covered in advertising, or the neo-natal unit was sponsored by J&J? What if every bed was like a NASCAR racer? Big logos and stickers all over them?

Who else might want access to what the hospital has? How about medical universities looking for a place to toss their students into hospital reality. What's that worth? The truth is, the hospital has a relationship with a teaching university - but the funding relationship is set by the government - at a rate well below the cost of putting up with learner doctor. It could work. It just doesn't.

Who else? The hospital customer base is probably a good testing environment for everything from new drugs to diapers. Maybe the hospital could renegotiate a bunch of it's supplier costs and turn them into testing revenues. I'm betting not - no question these companies already have their test facilities - but who knows - maybe there's a negotiation opportunity?

Politicians need access to what the hospitals offer. In fact, some of the best new funding comes at election time when politicians and parties want to sooth or cajole voters into their point of view. Maybe the Hospital could develop its political muscle more as a way of attracting even more funding. This is a certain opportunity.

I know I'm missing something here. With a little creativity there's got to be more opportunities. I'm interested in any thoughts from anyone on how else the hospital can give away its services and be rich like those internet companies. Ideas?

Saturday, March 22, 2008

Innovation Confusion

Unfortunately, the term innovation doesn't mean much to me.

Clearly it's important. I wouldn't be listening to my Ipod right now if Apple weren't a modern master at innovation.

Fortune's March 17 issue has a couple of articles on Apple. Apple's approach to innovation seems arrogant but effective - don't ask the consumer, just figure out what bugs us (Apple), eg, the cell phone, and build something better.

Compare that approach to Procter & Gamble, also covered in the same issue where 1) "we put the consumer at the center of everything we do", and 2) "we started thinking about innovation in new ways - we started from the premise that it's possible to run an innovation program in much the same way we run a factory".

So, the path is clear. There is no path.

Here are some thoughts for those as confused as I am about the innovation conversation:

> those with a strong desire to be more innovative probably need to clearly define why. What is the goal? The output? Is it a new product? A new process? A new way of managing that leads to more all round creativity?

> innovation is a strategy; is it a better strategy than some other way of achieving the same goal? For example, is innovation a better strategy than training everyone in the organization how to do their jobs better?

> if innovation is the right strategy, what is the plan? Who is in charge? What are the goals? Time frames? Process? Budgets?

For me, this is where the innovation conversation breaks down. In reality. I don't work for Apple or P&G. But the organizations I know, don't have an innovation plan. They haven't allocated budgets. No one is accountable for leading innovation.

Innovation will never happen in these organizations.

Right?

Wrong. I think.

Every organization I'm engaged with is developing either a new product or new approaches to doing whatever it is they do. They're growing and getting better at what they do.

Yes, some have significant challenges that require new and creative solutions. Maybe that requires a focus on innovation. Maybe.

What I am sure about is that all of them are making significant progress addressing what I would consider the basics of success in their business: better definition of corporate priorities and more focus on them; better, more capable managers who can mentor and lead teams; clearer measures and more effective processes for ensuring accountability.

As a result of progressing on these basics are these organization more innovative? Yeah, I think so.

Do they need to put more focus on innovation? No. At least that's not what I'm telling them.

More to come.

Wednesday, March 19, 2008

What I Believe

I do.

This may sound scary but way too often it's how I figure out what I'm actually thinking or worse, what I really believe in. You'd think/hope I might have that sorted before opening my mouth but apparently that's not always the case.

Today I had lunch with a new business prospect. To be honest, I'd heard most of what I said before, but it was a good refresher on some of the stuff I walk around believing in. Like this:

> I believe in measuring outputs, not inputs. This idea frequently comes up around how hard people are working. How hard people work, including how many hours they put in is an input. What they turn out, regardless of how hard they're working is an output. When employee outputs match corporate output expectations, we have success. As I said today - and have said way too often before - if we achieved success with everybody doing their jobs standing on their heads naked at 4 in the morning - how they did their jobs (the input) is irrelevant.

> I don't believe in ego. Famous quotes from me on ego: "Ego kills opportunity". "Ego will outdo intelligence, everyday of the week". "What an asshole".

> I believe in brutal honesty. The term brutal is a little dramatic and not really what I mean but it makes the point - err on the side of telling the truth, not the varnish. The reason I love brutal honesty is it makes things happen. It eliminates politics and confusion. Someone does a great job - tell them. Same person is doing a crappy job - tell them. A client's business is messed up - tell them. The client is messed up - find a new client. My favourite example of brutal honesty - my firing stories - I've only ever fired one person who didn't shake my hand when I fired them (he knew my track record and didn't do it just to mess me up). Why did all the others? Because long before they were fired and leading up to getting fired, they knew where they stood. I told them. We talked about it. How to fix things. How things were going. If/when firing day arrived it was never a surprise. More people need to try brutal honesty. It's treating adults like adults - and they will respond.

> I believe in beer. More people need to drink. It relieves stress and gets people together. I've known a lot of people who's best ideas came after 2 beer.

>I believe in marketing. Not tech - I hired a well known analyst from Gartner marketing. Real marketing. Dog food marketing. Starting with the consumer. Building a product that meets their needs. Selling it so they get the benefits. I've observed, and it scares me, how few companies actually understand marketing. PROMOTIONS AND SWAG ARE NOT MARKETING. There would be more successful companies if more managers understood the power of true marketing.

(Speaking of marketing, I saw a great tag line - on the side of a transport truck - for a promotions company - it said: "Crap to give away. Stuff to wear". Perfect mission statement. I would have loved to facilitate that work session!)

I'm sure I believe in a lot more but it didn't come up today. Saving it for tomorrow.

Tuesday, March 18, 2008

The Sky IS Falling

So, it's a bit of a surprise that I find myself saying I saw this one coming. I had good connections on this one. Some of the work I was doing exposed me to some of the casino workers. I saw their fear. I knew they were serious when they said 'we don't how bad it is'. These were players at big, well known casinos - not Bear Sterns, but like Bear Sterns - and originally they were talking about their exposure to asset backed paper - the original bet that started the melt-down we're all in.

The other thing I had exposure to was supposed experts analyzing the situation and ALWAYS being wrong. Knowing they were wrong was easy - month after month they've had to swallow their words from the month before. A nit of a problem that was supposed to be done with by Labour Day just kept getting worse and worse. Ultimately but only recently, the analysis (of I presume really bright people) has given way to what's now dead obvious - we are in a serious mess.

I'm sure there's a need/tendency/instinct in the financial world to be overly optimistic even when things don't look so good. Running around saying the sky is falling is probably a great way to get the sky to actually fall. But come on.

Here's an example. Do you think the US is in recession? If it's not, what do you think the chances are that will go in recession? Right. There's about a 100% chance. Yet, take a look at the BS still going on about a US recession. It's not like we're 'tipping towards it'. It's like we went over the cliff a while ago and are hurtling head long towards a deep, dark valley floor that's not just going to whack those crazy Americans, but everyone else, everywhere else too.

But I digress.

One of the great things when really bright people get smoked with reality, is how good they are at backwards looking analysis of stuff they should have seen in the first place. That 20/20 hindsight thing.

Fortune has a very good article called The End of Wall Street as We Know It on-line right now and probably in the magazine. Overlooking the fact they missed all stuff up til now, the article is an interesting dissection of financial 'powers' and the forces at play that got us where we are now.

A big one - and I've always said this - is performance compensation in the form of huge bonuses. I worked with a guy years ago who always looked for whatever 'goofy behaviour' would be driven from basic and sometimes simple looking decisions.

Well guess what?

Paying CEO's and traders millions and millions of dollars for taking huge risks is going to drive goofy behaviour. And it has. There shouldn't be any surprise that it has blown up. But there is.

Do you think the financial players learn from this? No. Not a hope. They will tighten up. Measure risk differently. Value it more harshly. But with the gazillions of dollars currently going into the system to keep it going, fuel for the next fire is already being pored.

As soon as there's a chance of getting rich again, the same goofy behaviour will take over. And a new set of billion dollar brain surgeons will be born. Just watch.

Tuesday, March 11, 2008

The Consultanator

Seriously, I'm pretty sure I'll survive and the truth is I'm enjoying it. I've never been a workout person. Genetically, I've been fortunate enough to stay pretty consistently within my weight category. Almost regardless of what I do. Beer? No problem. Nachos? Bring 'em on. Dessert? Cool. Do you have any cookies?

Of course being a reasonable weight and being the sleek fighting machine I am now are two different things. So I can't walk. I sure look like I should be able to!

So why am I doing it? I don't know. My wife was pushing me. I'd run out of excuses. I'm older and wiser now. Great genes aside, maybe eating nachos and drinking beer won't get me to 100.

So, some observations from a workout novice:

> having a trainer is good. He knows how those fancy looking machines work. He knows how to use them properly. He knows Melissa, the trainer I really wish I was working out with. Oh, and he won't let me quit on some exercise just because I fall on my face after the third push-up

> knowing how to work the machines is good. Hell, they have TV on them! Bring your ipod headphones and hear Elliot Spitzer apologize to his family. Makes you forget how much pain you're in

> picking a gym a little far from home is not so good. That's all you need on those days with 4 feet of snow. Great reason not to go to the gym.

> speedos...what can you say? Bad, bad idea for many men. Do these guys have any shame at all? Can't they see we're already in pain?

> warm towels. The BEST. Makes it all worthwhile.

So give me a couple of years. I'll either be dead or finally able to walk again. It really is great to be in shape!

Saturday, March 8, 2008

Hire Me Someone Good

Martyn's a recruiter. A good one. He started before the tech boom years ago. Built a serious firm. Saw it implode. Started over. Now very successful. Savvy. He's seen a lot. Been through a lot. Not a lot surprises him anymore.

As a consultant/CEO, I've used Martyn over and over to find me great people. He says his sweet spot is tech sales, tech sales management. Good for him. Having a positioning is good. However, I've used him to find marketing people, CFO's, customer service managers, you name it - in everything from not-for-profit through financial services.

Ultimately, the competitive advantage in recruiting is understanding what your client is looking for - a product of listening and client knowledge - and being fearless about reaching out to potential candidates. Martyn is the listener. His staff are the fearless ones, and they're good.

Every time Martyn and I get together, he ultimately regales me with his ugly client stories. Getting stiffed. Clients stealing candidates. Clients lying about what's happening in the business.

In every story, there are underlying themes about some clients and some client mentalities around recruiting - and business in general.

First, there's the notion some clients have that recruiting is some sort of commodity type business that is practiced equally by any/all firms in the business.

Second, that the universe is large and unconnected. That burning bridges and being an asshole doesn't have consequences.

Third, that negotiation is win-lose exercise, where the win-lose on fee is disconnected from the quality of the search.

Finally, that being funded by a VC means you're generally smarter than people with 3x the experience.

My perspective on any/all of these won't be a surprise. They're just dumb. Having a strong relationship with a recruiter is potentially one of the most important business relationships a growth manager can have. These relationships take time to nurture. A few searches. Getting to know how manager and recruiter come to see the same candidates in the same light.

Treating recruiters - and candidates - like commodities will backfire. The search community may seem large, but it's not. Sure there will always be a new firm to take an asshole client, but if you're the Board, do you really want your CEO building the future and sinking your investment on a new supplier every time there's a new search?

Some thoughts on working effectively with a recruiter.

> Have lunch, regularly. Get to know his/her business. Let him/her get to know you/your business. Get to know each other.

> Err on the side of loyalty. Forcing the recruiter to compete on every search will not lead to better quality candidates. It will lead to a semi-disengaged recruiter.

> Don't blow the relationship up over a search that goes wrong. There's valuable learning when mistakes happen. Early on working with Martyn I learned that when I provided the wrong specs, he hired me the wrong person. Good for him. Sucks to be me. Martyn helped me work it out and it's never happened again.

> Tap their expertise. Experienced recruiters like Martyn have seen everything. Negotiating techniques. Employment contracts. Salary levels. Tapping into that during and outside searches can be invaluable.

> Negotiate fee when it makes sense. Like when you're hiring multiple senior positions. But don't grind it every time. Yes, you can leap to a new recruiter who may do something dumb to get your business. Other than that, the recruiting fee model is pretty standard - and your choice needs to be on the quality of the recruiter, not winning a price negotiation.

> Finally, come to terms with how you feel about people/employees, and their impact on your business. My philosophy is simple. It's all about the people. No compromises. Does Google compromise? GE? Microsoft? Measure your recruiter on the basis of one thing - quality of the people you ultimately hire. As long as Martyn keeps delivering people who teach me how to get the job done, we'll be working together for a long time.

Oh, and here's the link to Martyn's site. http://www.mbassett.com/

Wednesday, March 5, 2008

Is the Sky Falling?

Yesterday I got a copy of a Merrill Lynch (US) analysis that summarizes their view of how bad things are/might be. Keeping in mind that over-reaction might always be a reality in both good times and bad (maybe it is, I don't know), this analysis is starkly negative.

Their view is based on the simple notion that what the US is facing is a credit contraction and that there is little doubt the consumer - up until now the primary engine keeping the US economy afloat - is about to go AWOL. The bottom line impact? As the report says "for global producers who sell $2.3 trillion of goods and services the US, 70% of which is geared to the consumer class, to be forewarned is to be forearmed - find a new customer somewhere else in the world".

Here's some of the thinking on what's happening:

> boomers have spent their adult years using credit, backed by the unstoppable increases in the value of their homes to live beyond their means

> savings have dried up (personal savings rates in the US are close to zero, down from over 10% in 1985)

> boomer retirements, which are just around the corner, were to be funded to a very large extent by home equity

> with house prices going the wrong way now, financial debt exceeds financial assets for many boomers - this is driving severely contracted spending on everything - from mortgage and other financial obligations (debt) - to home renovations and most other discretionary spending (everything but food)

> boomers who can no longer able to count on the value of their homes, will finally start saving for retirement

> with foreclosures, late payments and delinquencies soaring, credit providers are upping the hurdles and severely restricting credit that is available to consumers

> with more savings and less available credit, the drag on the economy will be intense. The author concludes: "we have identified the very serious economic issues that could make this recession much more problematic than previous post-war setbacks". Maybe the sky is falling.

Some numbers from the analysis:

> household liabilities absorb over 50% more of after tax personal income than it did 20 years ago - when interest rates were double what they are now

> the household debt-service ratio is 14.3% close to a record high

> the personal savings rate is .05%, almost a record low

> 1/3 of non-traditional mortgages are already in default

> 39% of people who bought a home in the US last year now find their mortgage is larger than the value of their home

> credit card approval rates have fallen to 32% from 40% a year ago - direct mail solicitations (remember those) to lure new customers are down 16%.

One of the things I've heard some say here is that inflation in the US will be a problem because of the rapid and high prices we're seeing in raw materials like oil and wheat.

This analyst doesn't buy it - having determined that inflation is driven by $ in the end-users pocket. Their belief: "in the absence of of a willing purchaser, higher input prices would simply come out of profit margins at the wholesaling and retailing levels". That makes sense.

I don't know whether the sky is falling or not. I'm not an economist - and frankly its not clear being an economist is much help. However, I do find it logical that the US consumer is in deep dooh dooh. With house prices imploding and credit companies restricting available credit, I don't find it much of a stretch to think that there will be a significant negative impact on business. It will be very interesting to watch what happens over the next year.

Leadership Smeadership

Okay. I know it’s a settings thing. Sometime, a long, long time ago – probably when leadership was being invented – I must have indicat...

-

These Daily Kos posts are just too fascinating to ignore. Electing an African American President, if it happens, will be a big deal....it&#...

-

via steverubel.com Here's a follow up to yesterday's recruiting conference post. I'm a big Posterous fan (and clearly using i...

-

Last night I got to have dinner with a group of 20 CIO’s. My role was to help bring the CEO perspective to them on what they do and h...